How Tidepoint Construction Group can Save You Time, Stress, and Money.

Wiki Article

The 45-Second Trick For Tidepoint Construction Group

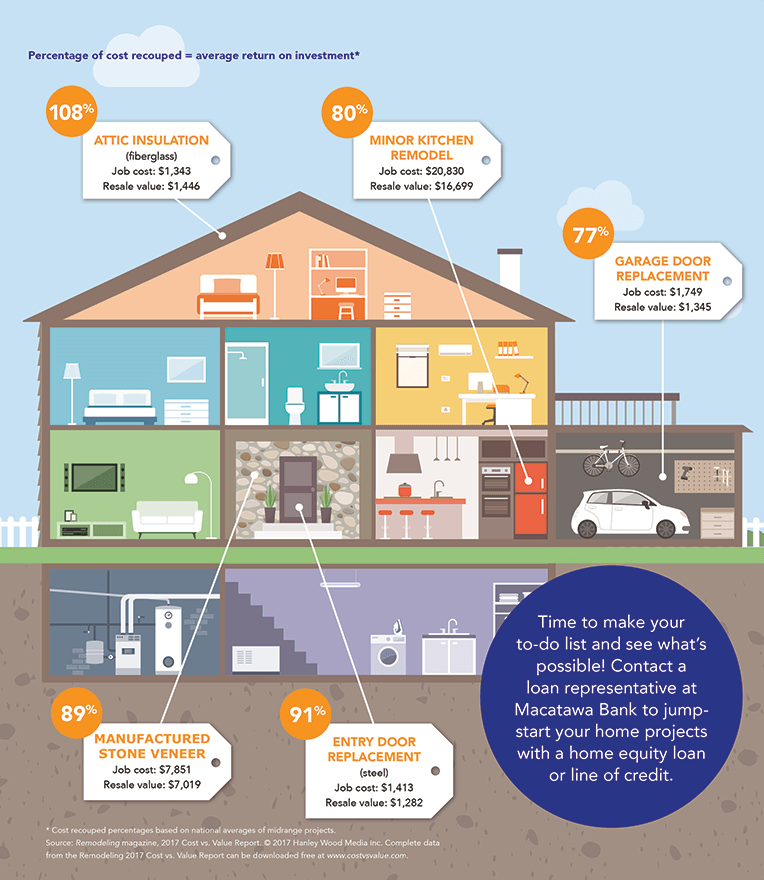

Residence equity fundings can be an affordable method to obtain against your home's equity when it comes to remodeling, because they're tax insurance deductible and offer the ways to increase the worth of your residence.

Improvement and also refurbishing your house can make your home a lot more enjoyable, and if done rightincrease your house's value along the way. While some tasks can include considerable worth to your home, others can really decrease the sale cost.

Think of the attic as an additional room or a workout area. Convert the cellar right into a family space. The even more flexible the space, the even more allure to potential buyers that can individualize the space. A high roi makes adding a deck worthwhile. One reason for this is decks increase the living area but expense much less to construct per square foot.

Fascination About Tidepoint Construction Group

go nowMounting a brand-new front door is a quick, cost-effective method to immediately improve your residence's look. A new front door is one of the leading ranking home renovations on the Cost vs. Worth Report.

Some house enhancement projects can actually negatively affect the resale worth of your home. The basic rule is the much more personalized the project is to your own individuality, needs, as well as taste, the much less most likely it is to have a favorable impact on the resale value.

Having to upgrade the space might turn them off from the house totally. Here are some jobs that can have an unfavorable resale value.

Households with toddlers may consider pools to be safety and security hazards. Some potential buyers aren't thinking about paying the extra energy and insurance policy costs connected with swimming pools. Think about whether it's functional all year. If you stay in southern The golden state or Florida, a pool may be a great selling factor.

Rumored Buzz on Tidepoint Construction Group

While you might enjoy your bathroom's marble flooring, a buyer could not be interested in paying a lot more for it. The best upgrades commonly don't have the same resale worth as top quality mid-range upgrades, unless you remain in a really premium house. Rather, purchase high quality devices, floor covering and also upgrades that interest a wide audience.

Individual financings can have lower interest prices than credit score cards and they supply the flexibility of making use of the funds as you see fit. We understand that obtaining authorized for a personal loanespecially one with a low-interest ratecan be testing if your credit scores isn't in fantastic shape.

Fixings are commonly only deductible for individual catastrophe occasions if the taxpayer makes a list of deductions and waives the conventional deduction. The tax obligation benefit is considered a tax obligation deduction rather than a tax obligation debt. For federally-declared calamity circumstances, repair services are typically deductible in the type of a tax obligation debt. Kitchen remodeling company near me. However, the policies might vary in between events.

Funding renovations don't include residence repair work and also have to be permanent or semi-permanent modifications that are refrained out of necessity. Tax deductions for funding renovations can just be recognized when your house is marketed. The remodelling's worth, or a percent, is included to the investment price of the residence. That amount then reduces the profit amount at the time of sale.

The Of Tidepoint Construction Group

Nevertheless, the checklist of policies associated with medical remodelling reductions is lengthy and also ever-changing. Medical improvements are generally dealt with as tax deductions as opposed to credit reports. Limitations concerning revenue degree, breakdown or whether the alterations influence building value are all at play. Get in touch with a tax obligation professional for information that might relate to any kind of medical remodelling.

Americans invested $363 billion on residence renovations, improvements, and also repairs in 2020 and $406 billion the following year. 8% rise from 2020 and virtually three times the average annual growth of 4.

House enhancement budgets have actually likewise enhanced over the last few years. https://hearthis.at/tidepointc0n/set/tidepointc0n/. According to the 2022 United State Houzz and also Home Research Study, from $15,000 in 2020 to $18,000 in 2021. This noted the very first time given that 2018 that property owners prepared to invest extra on their remodellings than the previous year. Houzz predicted spending would dip back to $15,000 in 2022 as well as has yet to launch the last numbers.

Houzz located that new home purchasers spent approximately $30,000 in improvementsdouble the existing nationwide mean. Temporary homeownersmeaning anyone that relocated into their home one to 5 years agospent $19,000 on standard. General contractor near me. Investing fads were a lot reduced for long-lasting house owners or locals who entered their homes 6 or even more years back.

Report this wiki page